does florida have capital gains tax on real estate

It lets you exclude capital gains up to 250000 up to 500000 if filing. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

/images/2021/01/28/capital-gains-tax-home-sales.jpg)

Capital Gains Tax And Home Sales Will You Have To Pay It Financebuzz

Special Real Estate Exemptions for Capital Gains.

. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. In order to recover any portion of the 15 that exceeds the amount actually owed under capital gains tax the seller must wait until the end of the year and file for a refund. Florida does not assess a state income tax and as such does not assess a state.

It depends on how long you owned and lived in the home before the sale and how much profit you made. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

Its called the 2 out of 5 year rule. Make sure you account for the way this. The State of Florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

The Rules You NEED to Know 1 week ago Jul 12 2022 Its called the 2 out of 5 year rule. Idaho does have a deduction of up. What is the capital gain tax for 2020.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Section 22013 Florida Statutes. Heres an example of how much capital gains tax you might.

In addition to a federal capital gains tax you might have to pay state. Special real estate exemptions for capital gains. You may however be subject to capital.

500000 of capital gains on real estate if youre married and filing jointly. The IRS typically allows you to exclude up to. These losses are therefore suspended until they can be netted against.

Income over 40400 single80800 married. A capital loss that cannot be realized in a given tax year due to passive activity limitations. Federal Cap Gains Tax vs.

However you will still owe federal capital gains tax on. Ncome up to 40400. The long-term capital gains tax rates are 0 percent 15.

Individuals and families must pay the following capital gains taxes. Long-term capital gains tax is a tax applied to assets held for more than a year. 500000 of capital gains on real estate if youre married and filing jointly.

Florida Cap Gains Tax. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. How It Works In 2022 - NerdWallet 1 week ago The IRS typically allows you to exclude.

That means you wont have to pay any Florida capital gains taxes. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. 250000 of capital gains on real estate if youre single.

If you owned and lived in the place for two of the five years before the sale then up to. Florida Capital Gains Tax.

Crypto Capital Gains And Tax Rates 2022

Guide To The Florida Capital Gains Tax Smartasset

Indexing Capital Gains Basis For Inflation Florida Chamber Of Commerce

2022 Capital Gains Tax Rates By State Smartasset

Florida Real Estate Taxes What You Need To Know

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Capital Gains Tax In The United States Wikipedia

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Home Sale Exclusion Tax Savings On Capital Gain Of A Principal Residence

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What Is It When Do You Pay It

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

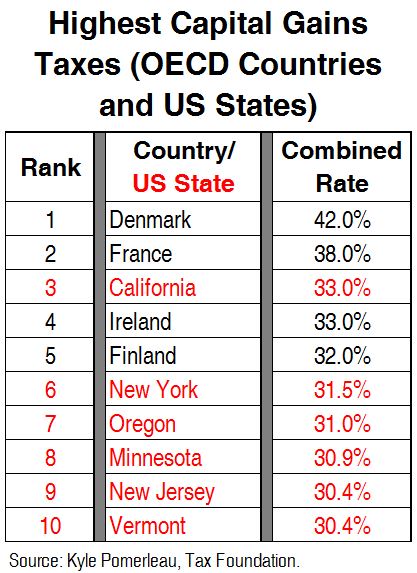

How High Are Capital Gains Taxes In Your State Tax Foundation

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A